Utah-based Loveland Innovations is a software company specializing in property data analytics and inspection tools for the insurance, roofing, and solar industries. Their IMGING inspection software uses AI to assist in the damage assessment phase of property inspections. It allows users to capture and analyze photos of damage – from weather, fallen trees, and branches, or manufacturing defects - on the roofs of both commercial and residential properties.

Challenge

Severe weather increases localized insurance claims. Roofs, in particular, are susceptible to wind, hail, and more. But even after a severe weather event, unless your roof is leaking, how often do you look at it?

When a roof is damaged, a homeowner files a claim on their property insurance. Occasionally, a contractor proactively approaches a homeowner after a weather event to inform them of a potentially damaged roof. If required, the insurance claim adjuster or contractor climbs the roof to inspect, record, and photograph the damage; they make decisions based on their training, experience, and expertise. An insurance adjuster then compares the submitted information to the insurance policy and historical weather to decide if any damage found is covered under the policy. After the adjuster has reviewed the findings from the contractor and performed their own inspection, they either deny or approve the claim.

This process poses numerous issues:

Climbing onto and photographing roofs is dangerous and time-consuming.

This manual inspection is repeated by multiple parties, increasing the chance of error or injury.

Guessing the exact date and area of the weather event after the fact – especially in a broad region – is inefficient.

Such inspections can cause damage if not performed properly.

Loveland Innovations’ IMGING application addresses each of these.

Solution

Loveland Innovations has designed an elegant inspection solution to act as an unbiased data collection and analysis tool. Insurance providers and roofers use the tool to increase efficiency. IMGING also introduces reliable historical weather data, creating a more complete picture of the damage.

Let’s revisit the process from the perspective of a roofing contractor:

A severe thunderstorm brings damage to several neighborhoods. A few days later, while scouting affected neighborhoods and speaking to homeowners, the contractor requests permission to inspect their roofs with a drone for free. They agree, and thanks to IMGING, the report will be ready in just 20 minutes.

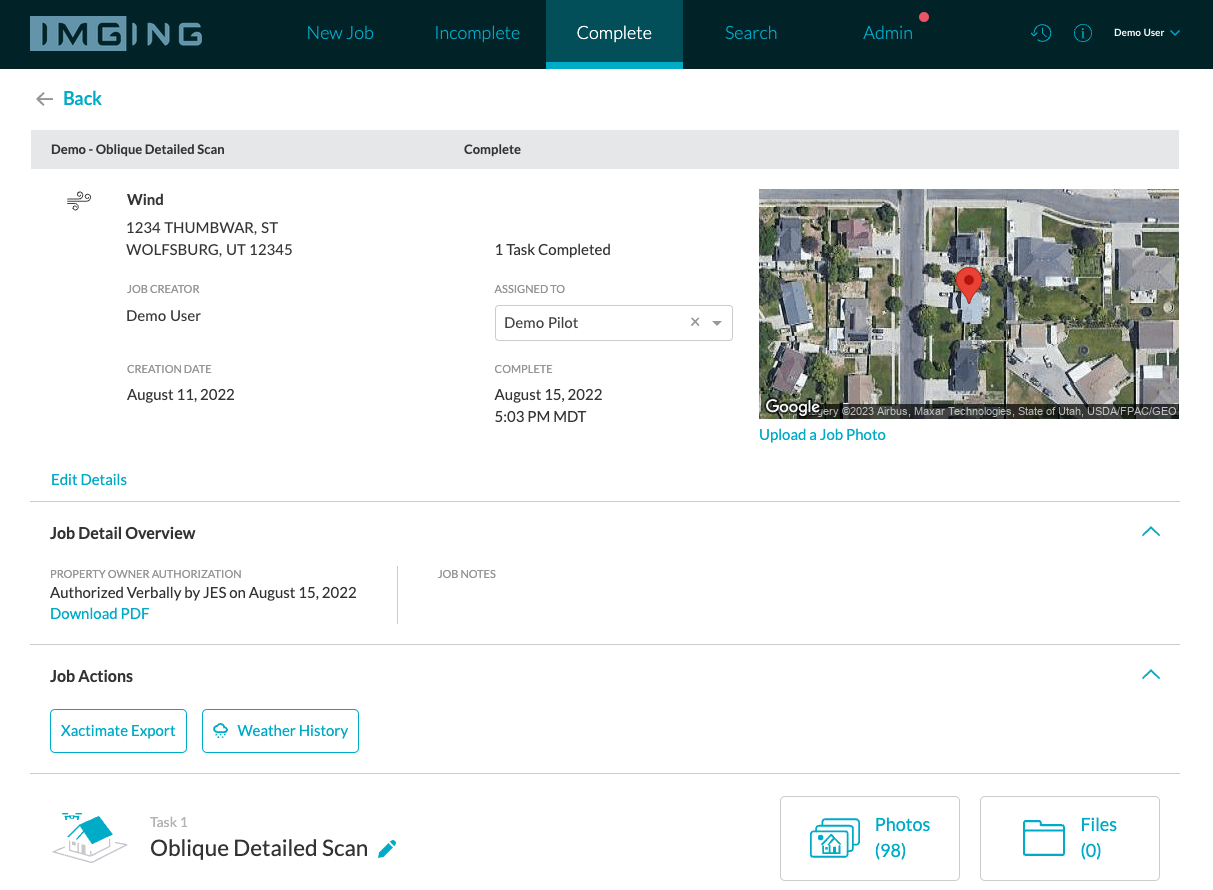

The contractor creates an inspection in the IMGING app on the drone’s smart controller. They then launch the automated drone flight from the app. The drone flies out, photographs each roof, flies back, and uploads the images to a cloud-based server. Once IMGING’s AI-powered damage detection is run on the collected photos, the contractor reviews them, confirms or denies damage, and notes the findings in the inspection. The app then runs Xweather's historical weather data via Xweather API, compares it with the home address, and includes it in your inspection report. Based on the prepared report, the contractor suggests the next steps.

The insurance company takes the claim from here: They validate it using the same historical weather data and the inspection report. The assessment can now be completed and approved or denied.

Results

The IMGING platform helps roofers and insurance providers answer two critical questions:

Has a severe weather event passed through the area in question?

Does the damage on the roof match the historical weather data?

The platform empowers both parties to work faster and more efficiently, as each has access to the project through the dashboard. Drone inspections are more cost-efficient compared to manual roof inspections and keep personnel safe. Thanks to localized historical weather API data, roofers acquire more business and help customers better in the claims submission process. Insurance providers are better equipped to quickly assess and approve or deny claims.

How can weather API elevate your operations? Get started with Xweather API for free and start building.